Sustainability / GovernanceCorporate Governance

- Basic Approach

- History of Strengthening Corporate Governance

- Corporate Governance Framework

- Effectiveness Evaluation of the Board of Directors

- Internal Audit

- Appointment and Compensation of Directors and Audit & Supervisory Board Members

- Policy Regarding Cross-Holding of Shares

- Communication with Shareholders and Investors

Basic Approach

Based on our Basic Philosophy of being a “company making lives better by co-creating value,” we see the reinforcement of corporate governance as a key management priority for improving corporate value and thereby contributing to the interests of our various stakeholders. Along with maintaining an efficient and dynamic organizational structure that enables us to quickly respond to changes in our business environment, we strive to preserve and reinforce the already highly effective corporate governance structure through which we consistently improve our corporate value by ensuring managerial transparency and legal compliance.

History of Strengthening Corporate Governance

Scroll left or right

| Date | Initiative | Purpose |

|---|---|---|

| June 1999 | Introduced the Executive Officer System | To separate supervisory and business execution functions clearly |

| June 2000 | Appointed Outside Directors | To strengthen decision-making and supervisory functions and ensure transparency in management |

| Established the Nomination and Compensation Committee | To improve objectivity and transparency in the nomination and compensation assessment process | |

| June 2003 | Shortened the term of office for Directors from two years to one | To clarify management responsibilities of Directors to shareholders and build a system that responds quickly to changes |

| March 2006 | Established the Information Disclosure Committee | To ensure the reliability of the information to be disclosed |

| April 2006 | Established the Risk Management Committee | To accurately understand and appropriately manage risks |

| May 2006 | Established the Basic Policy on Building an Internal Control System | To develop an internal control structure |

| August 2010 | Established the Internal Control Council | To build an internal control system and ensure the adequateness of its operation |

| January 2016 | Started to evaluate the effectiveness of the Board of Directors | To maintain and improve the effectiveness of the Board of Directors |

| June 2017 | Increased the ratio of Outside Directors to 50% | To ensure further transparency of decision-making and supervisory functions and management |

| January 2020 | Improved the method for evaluating the effectiveness of the Board of Directors | To introduce individual interviews in addition to surveys |

| June 2022 | Increased the ratio of Outside Directors to 60% | To ensure further transparency of decision-making and supervisory functions and management |

| January 2023 | Changed the method for evaluating the effectiveness of the Board of Directors | To use external experts as part of the evaluation process |

*The Basic Policy for Structuring the Internal Control System, established in March 2006, is revised as necessary, such as when organizational changes occur.

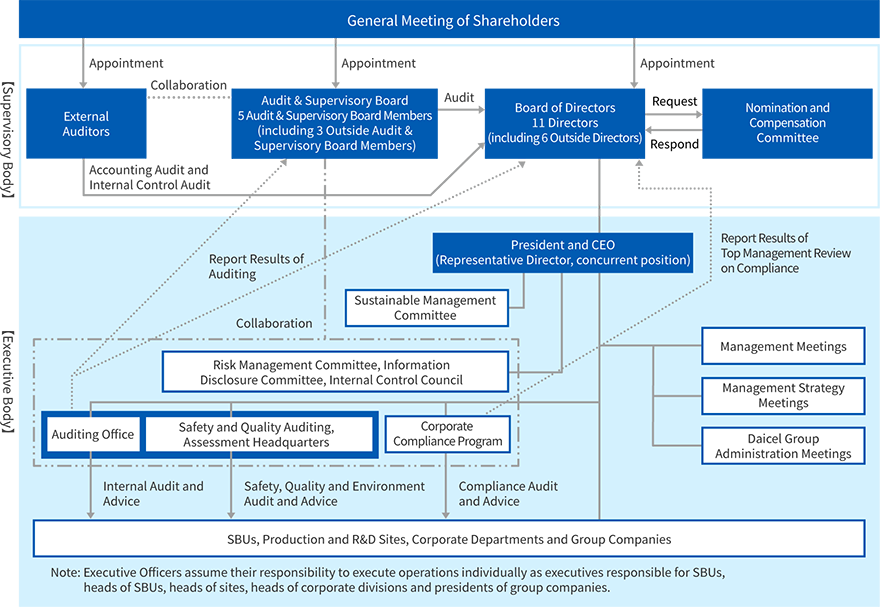

Corporate Governance Framework

Outline of the Corporate Governance Framework (as of June 21, 2024)

Electing multiple Outside Directors is a basic policy of the Daicel Group. By electing Outside Directors, who now comprise a majority of the Board of Directors, and considering their opinions and advice as informed by their diverse expertise, Daicel is working to bolster the oversight functions and appropriateness of management decisions made by the Board of Directors. Moreover, our Executive Officer system has enabled us to clearly separate our decision-making/supervisory functions from our business execution functions, allowing for a dynamic business execution structure that allows us to quickly respond to changes in the management environment.

Through this governance structure, we strive to consistently improve corporate value with all reasonable considerations made for our stakeholders.

Scroll left or right

| Item | Content |

|---|---|

| Type of organizational structure | Company with Audit & Supervisory Board |

| Chairperson of Board of Directors | Director, Chairperson of Board of Directors |

| Number of Directors | 11 (including 2 female Directors) |

| Number of Outside Directors | 6 (all 6 are independent Directors) |

| Number of Audit & Supervisory Board Members | 5 (including 1 female Audit & Supervisory Board Member) |

| Number of Outside Audit & Supervisory Board Members | 3 (all 3 are independent Audit & Supervisory Board Members) |

| Number of Executive Officers | 20 (including 5 officers concurrently serving as Directors) |

| Number of Board of Director meetings held in FY2024/3 (average attendance rate of outside Directors/outside Audit & Supervisory Board Members) |

15 (100%/97.8%) |

| Number of Audit & Supervisory Board meetings held in FY2024/3 (average attendance rate of Outside Audit & Supervisory Board Members) |

15 (100%) |

| Term of office for Directors | 1 year |

| Term of office for Audit & Supervisory Board Members | 4 years |

| Average term in office for Directors | 4.6 years |

| Average term in office for Audit & Supervisory Board Members | 3.4 years |

| Voluntary advisory body to the Board of Directors | Nomination and Compensation Committee is composed of 8 Directors (including 6 Outside Directors) and chaired by an Outside Director. Meetings held in FY2024/3: 9 |

| Compensation system for Directors and Audit & Supervisory Board Members* |

|

| External Auditor | Deloitte Touche Tohmatsu LLC |

*The compensation system is also used for executive officers and others.

The ratio of (1), (2), and (3) above is generally 55:30:15, with the ratio changing based on the individual’s position.

Corporate Governance Framework (as of June 21, 2024)

Board of Directors

The Company recognizes a role of Board of Directors as following: setting the direction we should aim for and creating a concrete business strategy toward the target and supervising the execution of business and business operations from an objective point of view. Ensuring this effectiveness of the role of Board of Directors, it is constituted of five Inside Directors and six Outside Directors: the former have a profound insight about our businesses, the latter have a wealth of experience in the business management and diverse expertise (including nine men and two women in the Board as a whole). Also, all of Outside Directors are independent. The details about them are indicated in the part titled “Information about Directors and Audit & Supervisory Board Members” in the Securities Report. The Outside Directors satisfy the “Standards for Independence of Outside Directors/Outside Audit & Supervisory Board Members” as defined by the Company. Therefore, we organize the Board of Directors in a way that allows the Outside Directors, who are in a majority on the Board of Directors, to state their opinions to the Company’s management from the objective and independent Directors’ point of view.

The President and CEO serves as the Chairperson of the Board of Directors, but in the unlikely event that proceedings are not conducted fairly and impartially, the Board of Directors confirms that the Outside Directors, who make up the majority of the Directors, will act as a deterrent and take measures such as correcting the Chairperson's conduct of the proceedings or appointing another person as the Chairperson.

The Board of Directors has a meeting once a month as a general rule. The Board of Directors meets to make decisions concerning important management issues and supervise the execution of duties and operations. In addition, five Audit & Supervisory Board Members, three of whom are the Outside Audit & Supervisory Board Members, also attend the Board of Directors meetings, where they express their opinions appropriately in case of necessity.

The term of office for Daicel’s Directors is one year. This short term of office enables Daicel shareholders to increase their involvement in the appointment of Directors. At the same time, it allows the Company to better clarify the management responsibilities of its Directors and thereby strengthen its corporate governance.

It is necessary for each Director to develop his/her knowledge of our business to ensure effective supervision of the execution of business. Therefore, we provide opportunities for mainly Outside Directors and Outside Audit & Supervisory Board Members to tour our manufacturing sites and provide an explanation of Daicel’s departments, products and technologies as well as the Board of Directors’ meetings.

The activities of the Board of Directors are as follows.

Number of meetings of the Board of Directors held in FY2024/3 was 15

Number of Board of Directors resolutions, discussions, and reports are as follows

| Resolution Report Category | Number |

|---|---|

| IR | 5 |

| Governance | 26 |

| Compliance, Corporate Ethics | 6 |

| Sustainability | 2 |

| Audit & Supervisory Board Members, External Auditors | 4 |

| Management Strategies | 13 |

| Accounting, Finance | 40 |

| Individual Cases | 7 |

| HR, Remuneration | 27 |

| Internal Audits | 2 |

| Total | 132 |

FY2024/3 Board of Directors

Summary of Major Resolutions, Discussions, and Reports Related to Governance and Compliance

Scroll left or right

| Date | Agenda Category | Agenda | Summary of Resolutions, Discussions, and Reports |

|---|---|---|---|

| April 26, 2023 | Governance | Basic Policy for the Internal Control System | Partial revision of the Basic Policy for Structuring the Internal Control System |

| March 28, 2024 | Enforcement status of the Basic Policy for Structuring the Internal Control System | ||

| April 26, 2023 | Director and Audit & Supervisory Board Member training track record | Information provision and status of training for Directors and Audit & Supervisory Board Members | |

| April 26, 2023 | Effectiveness evaluation of the Board of Directors | Reporting and discussion of the results of the effectiveness evaluation of the Board of Directors | |

| June 23, 2023 | Corporate Governance Code | Status of response to the Corporate Governance Code | |

| July 5, 2023 | Cross-shareholdings | Consideration of the holding status of Daicel’s cross-held shares | |

| March 28, 2024 | Risk management | FY2024/3 risk management activity status | |

| April 26, 2023 | Compliance and corporate ethics | Establishment of Code of Conduct and Ethical Standards | Review and establishment of Daicel Group Code of Conduct and Ethical Standards |

| May 11, 2023 | Psychological safety | Lecture on “Psychological Safety” for ensuring organizational health by Audit & Supervisory Board Member Junichi Mizuo | |

| August 3, 2023 | Status of Group whistleblower system | Report on the contents and response status, etc. of whistleblowing within the Daicel Group | |

| November 2, 2023 | |||

| February 6, 2024 | |||

| March 28, 2024 | Corporate ethics activities | FY2024/3 Daicel Group Corporate Compliance Activity Status Report | |

| May 11, 2023 | Audit & Supervisory Board Members / External Auditors | Audit by Audit & Supervisory Board Members | Reporting on resolutions of the Audit & Supervisory Board, audit plans, audit reports, etc. |

| June 23, 2023 | |||

| July 5, 2023 | |||

| March 28, 2024 | Audit & Supervisory Board Members / External Auditors | Confirmation of execution of business | Explanation and discussion related to confirmation of execution of business |

| April 26, 2023 | Internal audits | Internal audits plans | Report on FY2024/3 internal audit plan |

| June 23, 2023 | Internal control over financial reporting | Reporting and discussion of internal control reports related to financial reporting |

Audit & Supervisory Board

The Audit & Supervisory Board comprises five members (four men and one woman), and a majority of three members are independent Outside Audit & Supervisory Board Members that meet the standards for independence of Outside Directors and Outside Audit & Supervisory Board Members. Outside Audit & Supervisory Board Members possess extensive experience in accounting, finance, legal affairs, and other disciplines, as well as broad insight into fields such as CSR, corporate governance, and business ethics, and fulfill auditing functions from a third-party, independent standpoint.

The Audit & Supervisory Board holds meetings to share information, deliberate on, and make decisions about important issues related to the Company’s audits. It also regularly attends Board of Directors meetings and important internal meetings held by Standing Audit & Supervisory Board Members, and regularly meets with the Representative Director, Outside Directors, and External Auditors. In addition, it works to improve auditing effectiveness through such means as communicating with the Internal Audit Department’s Auditing Division when needed.

The activities of the Audit & Supervisory Board Members are as follows.

Scroll left or right

| Category | Activity | Relevance | |

|---|---|---|---|

| Full-time | Outside | ||

| (1) Director | Attendance at Board of Directors meetings | ○ | ○ |

| Regular meetings with the Representative Director (exchange of opinions, etc.: held semiannually) | ○ | ○ | |

| Regular meetings with Outside Directors (exchange of opinions, etc.: held semiannually) | ○ | ○ | |

| (2) Business execution | Interviews and hearings with the President and CEO, Senior Managing Executive Officer, and Managing Executive Officers (implemented for 8 of 8 planned people) | ○ | - |

| Attendance at important meetings, such as Management Meetings, Planning Meetings, Management Strategy Meetings and the Internal Control Council | ○ | - | |

| Perusal and confirmation of important documents (Board of Directors meetings minutes, approval requests, approval documents, etc.) | ○ | ● | |

| Audits of each Company department (implemented for 22 of 23 planned departments) | ○ | ● | |

| Visits to each business site (implemented for 7 of 7 planned sites) | ○ | ● | |

| (3) Subsidiaries | Visits to domestic and overseas Group companies (27 planned companies, and implemented for 28 companies) | ○ | ● |

| Regular meetings with Audit & Supervisory Board members of Group companies (reports on the status of each company's audits, exchanges of opinions, etc.: held annually) | ○ | ● | |

| (4) Internal audits | Regular meetings with the Internal Audit Department (explanation of the plan, report on the implementation status, exchange of opinions, etc.)

|

○ | ● |

| (5) Accounting audits | Regular meetings with the External Auditor (explanation of audit plan, quarterly review reports, audit results reports: held quarterly) | ○ | ○ |

| Meetings with the External Auditor (in addition to the above, exchanges of opinions, consultations, etc.: held as necessary) | ○ | - | |

| External Auditor evaluation (held annually) | ○ | ○ | |

*Relevance [ ○: Responsible ●: Optional / Partially responsible ]

With respect to Key Audit Matters (KAM), along with attending regular meetings and gatherings with External Auditors to confirm brainstorming progress, the Audit & Supervisory Board communicate important information to the executive team as needed.

Nomination and Compensation Committee

The Nomination and Compensation Committee, which is chaired by an Outside Director and consists of Outside Directors, who are in the majority of the Board of Directors, and Representative Directors, reports on the personnel and remuneration of Directors, Executive Officers and other officers in response to requests from the Chairperson of the Board of Directors or Chairperson of the Audit & Supervisory Board, from the point of view of ensuring objectivity, transparency, and validity in the process of decision.

The Nomination and Compensation Committee is administered in line with the regulations for the Nomination and Compensation Committee. This committee has the authority to state the opinions in response to requests from the chairperson of the Board of Directors regarding the decision of the candidates for the Directors and the Audit & Supervisory Board Members, the appointment of executive officers, etc. and the compensation assessment process of Directors and Audit & Supervisory Board Members. The chairperson of the Board of Directors must report the response of the Nomination and Compensation Committee in the Board of Directors meetings regarding the decision of the candidates for Directors and Audit & Supervisory Board Members and the decision on compensation for Directors and Audit & Supervisory Board Members. The Board of Directors meets to make decisions concerning these topics in consideration of responses from the Nomination and Compensation Committee.

The activities of the Nomination and Compensation Committee are as follows.

Number of meetings of the Nomination and Compensation Committee in FY2024/3 was 9

Number of Committee agenda items are as follows

| Agenda Category | Number |

|---|---|

| Appointment of Executive Officers, etc. | 14 |

| Compensation for Executive Officers, etc. | 2 |

| Appointment of Directors and Audit & Supervisory Board Members | 4 |

| Compensation for Directors and Audit & Supervisory Board Members | 5 |

| Total | 25 |

Executive Officers

The Company has an Executive Officer System in order to clearly delineate decision-making and supervisory functions from business execution functions and further energize corporate management through swift decision-making.

The Company’s 20 Executive Officers (five of whom are also Directors) execute operations as heads of SBUs, sites, or corporate divisions or as presidents of Group companies.

In accordance with the Rules Concerning Circulars (rules relating to job functions) these Executive Officers are given a certain measure of decision-making authority that they exercise to make swift decisions after accurately assessing business opportunities. Certain committees have an Executive Officer nominated by the President and CEO to serve as Chairperson in overseeing efforts to develop driven, responsible managers that will achieve the aims of the medium-term strategy and long-term vision of the Company.

These Executive Officers report important matters concerning business execution at monthly Board of Directors meetings and take advice from Directors and Audit & Supervisory Board Members to serve in supervising the Board of Directors.

Management Meetings

In the course of the President and CEO carrying out basic policies on corporate management as determined by the Board of Directors, the Management Meetings holds discussions and makes decisions about important business plans and business execution plans, as well as individual business operation execution.

Generally meeting twice a month, the committee consists of the President and CEO as well as Directors (excluding Outside Directors) and Executive Officers nominated by the President and CEO. The committee also has two Standing Audit & Supervisory Board Members that give their views on matters when needed.

The committee reports on the progress and results of its proceedings at monthly Board of Directors meetings and takes advice from Directors and Audit & Supervisory Board Members to serve in supervising the Board of Directors.

Composition of Each Body and Status of Director Activities (as of June 21, 2024)

Scroll left or right

| Name | Position | Term in Office | Independent Director | Execution of Operations | Board of Directors (FY2024/3 Attendance) | Audit & Supervisory Board (FY2024/3 Attendance) | Nomination and Compensation Committee (FY2024/3 Attendance) | Remarks |

|---|---|---|---|---|---|---|---|---|

| Yoshimi Ogawa | Representative Director President and CEO | 13years | ● | ● (93%) |

● (88%) |

Chairperson of Board of Directors | ||

| Kotaro Sugimoto | Representative Director | 5 years | ● | ● (100%) |

● (100%) |

|||

| Yasuhiro Sakaki | Director | 4 years | ● | ● (100%) |

||||

| Toshio Shiwaku (New appointment) |

Director | - | ● | ● (-) |

||||

| Naotaka Kawaguchi (New appointment) |

Director | - | ● | ● (-) |

||||

| Teisuke Kitayama | Outside Director | 6 years | ● | ● (100%) |

● (100%) |

|||

| Toshio Asano | Outside Director | 5 years | ● | ● (100%) |

● (100%) |

Chairperson of the Nomination and Compensation Committee | ||

| Takeshi Furuichi | Outside Director | 4 years | ● | ● (100%) |

● (100%) |

|||

| Yuriya Komatsu | Outside Director | 2 years | ● | ● (100%) |

● (100%) |

|||

| Mari Okajima | Outside Director | 1 year | ● | ● (100%) |

● (100%) |

|||

| Keita Nishiyama | Outside Director | 1 year | ● | ● (100%) |

● (100%) |

|||

| Mikio Yagi | Standing Audit & Supervisory Board Member | 1 year | ● (100%) |

● (100%) |

Chairperson of the Audit & Supervisory Board | |||

| Kenichi Yamada (New appointment) |

Standing Audit & Supervisory Board Member | - | ● (-) |

● (-) |

||||

| Junichi Mizuo | Outside Audit & Supervisory Board Member | 6 years | ● | ● (100%) |

● (100%) |

|||

| Hideo Makuta | Outside Audit & Supervisory Board Member | 4 years | ● | ● (93%) |

● (100%) |

|||

| Hisae Kitayama | Outside Audit & Supervisory Board Member | 2 years | ● | ● (100%) |

● (100%) |

*Attendance rate is for FY2024/3.

Effectiveness Evaluation of the Board of Directors

Every year, Daicel conducts and publicly releases a summary of an effectiveness evaluation of the Board of Directors, which aims to maintain and improve the Board’s performance and find the most suitable approach to corporate governance.

FY2024/3 Initiatives Based on the FY2023/3 Effectiveness Evaluation

In view of the Effectiveness Evaluation of FY2023/3, in FY2024/3 we spent more time reporting on the status of execution of management strategies, matters related to return on capital and stock prices, and the status of initiatives related to sustainability and human capital in order to further enhance discussions at the Board of Directors.

Summary of the Evaluation Process and Results

Scroll left or right

| Evaluation process | Questionnaires were distributed to all Directors and Audit & Supervisory Board Members, the results were further deepened through individual interviews, and the results were summarized and analyzed by the secretariat and reported to the Board of Directors for discussion. |

|---|---|

| Main evaluation item |

|

| Overview of evaluation results |

Members of the Board of Directors engaged in productive discussions with Outside Directors and Outside Audit & Supervisory Board Members who actively offered their opinions, and we were able to confirm that the effectiveness of the board is generally satisfactory. On the other hand, it was confirmed that there are issues to be discussed for further improvement of effectiveness. The main issues raised are as follows:

|

| Actions to be taken | We will discuss the above issues at the Board of Directors meeting for FY2025/3 and confirm our commitment to continue addressing them in order to further enhance effectiveness. |

Internal Audit

Daicel has established an Auditing Division, Corporate Compliance Program, and Safety and Quality Auditing Division as internal audit units, and works to enhance the effectiveness of audits while communicating with Audit & Supervisory Board Members as appropriate.

| Auditing Division | The Auditing Division, in cooperation with the internal audit organization of the Daicel Group, conducts annual audits of each site, including Group companies. In addition, based on the results of audits, it supports the appropriate business activities of the audited organization by proposing improvements to problems. It regularly reports audit results to the Board of Directors and the Audit & Supervisory Board. |

|---|---|

| Corporate Compliance Program | |

| Safety and Quality Auditing Division, Assessment Headquarters | The Safety and Quality Auditing Division conducts annual audits on safety,* quality, and the environment at each site, including Group companies. The results of audits are not only fed back to the audited organizations, but are also shared across the entire Group to promote improvements. It regularly reports audit results to the Management Strategy Meetings and the Audit & Supervisory Board. *“Safety” includes occupational health and safety. |

Appointment and Compensation of Directors and Audit & Supervisory Board Members

Appointment and Nomination Procedures for Directors and Senior Management

In nominating and appointing Directors, Audit & Supervisory Board Members, and management executives such as Executive Officers, Daicel seeks individuals with the right personality, knowledge, motivation, ethical stance and management perspectives for leading the Company and who meet the basic criteria of supporting and upholding the Daicel Group’s Basic Philosophy, Sustainable Management Policies, Daicel Group Code of Conduct, and Ethical Standards of Daicel Group, and possess the necessary credentials and experience for enhancing Daicel’s medium- and long-term corporate value.

The Board of Directors decides on nominations and appointments based on the advice of the Nomination and Compensation Committee.

Daicel has declared its support for the Challenge Initiatives for 30% of executives* to be women by 2030 (#Here We Go 203030), sponsored by Keidanren. Daicel has positioned Diversity & Inclusion (D&I) as a key materiality. The Company will seek to further enhance our corporate value by combining the power of diverse human resources, including women.

*Executives include senior managers, such as Directors, Audit & Supervisory Board Members, and Executive Officers.

Reasons for Appointment and Status of Activities of Outside Directors and Outside Audit & Supervisory Board Members

Daicel appoints its Outside Directors in accordance with its own Standards for Independence of Outside Directors/Outside Audit & Supervisory Board Members, which require that Outside Directors be sufficiently independent and present no risk of conflicts of interest with general shareholders. Daicel also designates all Outside Directors who satisfy the independence criteria as independent Directors.

Reasons for Appointment of Directors and Audit & Supervisory Board Members (as of June 21, 2024)

Scroll left or right

| Directors | Position | Reason for Appointment |

|---|---|---|

| Yoshimi Ogawa | Representative Director | Mr. Ogawa has demonstrated strong leadership in guiding the entire Group toward achieving higher corporate value as the President and CEO of the Company since June 2019. We determined that he is qualified to manage the Daicel Group and its global business given his track record and wealth of experience, achievements and insights related to the overall management of Daicel. |

| Kotaro Sugimoto | President and CEO | Mr. Sugimoto possesses a wealth of experience, achievements and insights related to the overall management of Daicel, fostered as the head of administrative departments, including finance and accounting, as well as compliance. We determined that he is qualified to manage the Daicel Group and its global businesses. |

| Yasuhiro Sakaki | Director | Mr. Sakaki possesses a wealth of experience, achievements and insights related to the overall management of Daicel, fostered as president of an overseas subsidiary and head of the Safety segment and departments involved in promoting corporate strategy. We determined that he is qualified to manage the Daicel Group and its global businesses. |

| Toshio Shiwaku | Director | Mr. Shiwaku possesses a wealth of experience, achievements and insights related to the corporate management of the Daicel Group and overseas business, fostered by being responsible for areas such as research and development, management strategy, and new business development at Polyplastics Co., Ltd., a major subsidiary of the Daicel Corporation Group, and also serving as its Representative Director and President. We determined that he is qualified to manage the Daicel Group and its global business. |

| Naotaka Kawaguchi | Director | Mr. Kawaguchi possesses a wealth of experience, achievements, and insights related to Daicel’s management and production technologies, such as serving as a manager of Daicel’s Safety Business, the president of overseas subsidiaries, a manager of the division involved in the planning and implementation of measures for improving Daicel’s production technology capabilities and solving issues. We determined that he is qualified to manage the Daicel Group and its global business. |

| Teisuke Kitayama | Outside Director | Mr. Kitayama possesses a wealth of insights and experience, fostered as a manager of financial institutions, and applies these in the management of Daicel. |

| Toshio Asano | Outside Director | Mr. Asano possesses a wealth of insights and experience, fostered as a manager of companies that manufacture and sell chemical goods, and applies these in the management of Daicel. |

| Takeshi Furuichi | Outside Director | Mr. Furuichi possesses a wealth of insights and experience fostered as a manager of a financial institution, and applies these in the management of Daicel. |

| Yuriya Komatsu | Outside Director | Ms. Komatsu possesses a wealth of insights and experience, fostered as a manager of investment companies in Japan and overseas and communications companies, and applies these in the management of Daicel. |

| Mari Okajima | Outside Director | Ms. Okajima possesses highly specialized knowledge and experience as an academic expert who has conducted various research related to customer satisfaction and social issues with a focus on the SDGs, and applies these insights and experience in the management of Daicel. |

| Keita Nishiyama | Outside Director | Mr. Nishiyama possesses in-depth knowledge of economic, industrial, and IT policy that he has cultivated during his duties at the Ministry of Economy, Trade and Industry, and a wealth of knowledge as a manager that he has cultivated at an electric power company and investment company, and applies these insights and experience in the management of Daicel. |

Scroll left or right

| Audit & Supervisory Board Members | Position | Reason for Appointment |

|---|---|---|

| Mikio Yagi | Standing Audit & Supervisory Board Member | Mr. Yagi has served as the President and CEO of a Group company as well as the responsible person for the Safety segment, etc. Given his insights from by his extensive experience and special expertise in the fields related to production, sales, product quality, etc. of Daicel, we determined that he is qualified to serve as an Audit & Supervisory Member responsible for implementing audits based on a neutral and objective perspective to ensure sound management at Daicel. |

| Kenichi Yamada | Standing Audit & Supervisory Board Member | Mr. Yamada has served as the president of a Group company, as well as the head of Daicel’s business support division, and the division responsible for planning sustainable management. Given his insights from his extensive experience in corporate governance and sustainability within the Group, we determined that he is qualified to serve as an Audit & Supervisory Board Member responsible for implementing audits based on a neutral and objective perspective to ensure sound management at Daicel. |

| Junichi Mizuo | Outside Audit & Supervisory Board Member | Mr. Mizuo possesses highly specialized knowledge and experience as a scholar of CSR, corporate governance, and business ethics. He has also served as an Outside Director and is experienced in practical business operations. For these and other reasons, we have determined that he is qualified for the post of Outside Audit & Supervisory Board Member. |

| Hideo Makuta | Outside Audit & Supervisory Board Member | Mr. Makuta possesses highly specialized knowledge and extensive insights as an attorney at law and has served as a prosecutor at the Supreme Prosecutors Office, a member of the Fair-Trade Commission, and an outside officer of companies. Given this track record, we have determined that he is qualified for the post of Outside Audit & Supervisory Board Member. |

| Hisae Kitayama | Outside Audit & Supervisory Board Member | Ms. Kitayama possesses highly specialized knowledge and extensive insights as a certified public accountant and has served as a partner at a major auditing firm and an executive for an association of certified public accountants.She also has experience with corporate affairs as an Outside Director. For these and other reasons, we have determined that she is qualified for the post of Outside Audit & Supervisory Board Member. |

*The Directors and Kenichi Yamada and Hideo Makuta, Audit & Supervisory Board Members, were appointed on June 21, 2024. Other Audit & Supervisory Board Members were appointed on the day of the Ordinary General Meeting of Shareholders held in previous fiscal years.

Directors’ and Auditors’ Primary Areas of Knowledge and Experience (Skill Matrix) (as of June 21, 2024)

Scroll left or right

| Name | Corporate management | Global management | Marketing /Business planning | Technology/R&D | Finance and accounting | Legal affairs, intellectual property, risk management | DX | Sustainability | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Environment | Diversity, Equity &Inclusion | ||||||||||

| Directors | Yoshimi Ogawa | ● | ● | ● | ● | ● | |||||

| Kotaro Sugimoto | ● | ● | ● | ● | ● | ||||||

| Yasuhiro Sakaki | ● | ● | ● | ● | ● | ||||||

| Toshio Shiwaku | ● | ● | ● | ● | ● | ||||||

| Naotaka Kawaguchi | ● | ● | ● | ● | ● | ||||||

| Teisuke Kitayama | Outside | ● | ● | ● | ● | ● | |||||

| Toshio Asano | Outside | ● | ● | ● | ● | ||||||

| Takeshi Furuichi | Outside | ● | ● | ● | ● | ||||||

| Yuriya Komatsu | Outside | ● | ● | ● | ● | ● | |||||

| Mari Okajima | Outside | ● | ● | ● | |||||||

| Keita Nishiyama | Outside | ● | ● | ● | ● | ||||||

| Audit & Supervisory Board Members | Mikio Yagi | ● | ● | ● | ● | ● | |||||

| Kenichi Yamada | ● | ● | ● | ● | ● | ||||||

| Junichi Mizuo | Outside | ● | ● | ● | |||||||

| Hideo Makuta | Outside | ● | ● | ● | |||||||

| Hisae Kitayama | Outside | ● | ● | ● | |||||||

*Up to five items that are particularly expected of each person are listed. The above matrix does not represent all the knowledge and experience of each person.

Compensation for Directors and Audit & Supervisory Board Members

- 1Basic Policy

- (1)The Compensation of Directors and Audit & Supervisory Board Members shall be determined by Board of Directors’ resolutions for Directors and Audit & Supervisory Board Members’ discussions for Audit & Supervisory Board Members, within the scope of the total amount of compensation, etc. approved at the General Meeting of Shareholders.

- (2)The Compensation of Directors shall consist of monthly compensation, performance-based bonuses, and stock compensation, which will generally be paid according at a 55:30:15 ratio that is subject to change according to the position. This rule does not apply to Outside Directors, who shall be paid only monthly compensation. The compensation of Audit & Supervisory Board Members shall consist solely of monthly compensation.

- (3)To ensure objectivity, transparency, and validity regarding compensation, the Board of Directors makes its decisions following deliberations based on recommendations made by the Nomination and Compensation Committee.

- 2Basic Policy on Compensation

-

(1)Monthly Compensation

In principle, the monthly compensation of Directors and Audit & Supervisory Board Members is a fixed amount paid in accordance with internal rules that are determined by the Directors’ duties and job titles in business execution and as to whether or not the Audit & Supervisory Board Members are fulltime.

Regarding monthly compensation, the Company has revised the compensation to an appropriate and fair level reflective of its business performance, accomplishment of medium- and long-term business plans, and social situations, among other factors. -

(2)Performance-linked remuneration

Performance-linked remuneration of Directors is paid in accordance with the accomplishment of performance indicators designated by the Board of Directors.

Currently, net sales and operating income are used as the indicators to evaluate things such as business growth, market expansion, and improvements in the earning power of our core business. These indicators are given a 50-50 weighting, and the basic amount of the performance-based bonus is calculated by multiplying the rank-based amount with a payment rate that fluctuates between 0% and 200%, depending on the level of accomplishment of the performance indicators. The payout rates linked to the indicators are calculated as shown in the table below.Indicator Weight Target achievement rate Coefficient Consolidated net sales 50% 120% or more 200% More than 100% but less than 120% *1 100% 100% More than 80% but less than 100% *2 80% or less 0% Consolidated operating income 50% 120% or more 200% More than 100% but less than 120% *1 100% 100% More than 80% but less than 100% *2 80% or less 0% - *1These bonuses are proportional to the percentage that the target figure was achieved, within a range of 101% to 199%.

- *2These bonuses are proportional to the percentage that the target figure was achieved, within a range of 1% to 99%.

The final amounts of performance-based bonuses are determined by assessing the status of each Director from the perspectives of practicing Sustainable Management Policy and accomplishing Mid-Term Management Strategy and adding or subtracting up to 20% to or from the basic amounts of the performance-based bonuses.

-

(3)Restricted Stock Compensation System

Daicel introduced the Restricted Stock Compensation System to step up value sharing with shareholders and motivate Directors to contribute more to medium- to long-term improvement in corporate value. The stocks cannot be transferred for a period of 30 years, and the Board of Directors decides on an amount for each eligible individual, which is then divided by the stock price at a certain point to calculate the number of shares to be awarded.

-

(1)Monthly Compensation

*The executive compensation system is current as of April 1, 2024. Daicel does not have a system for paying retirement benefits to officers.

FY2024/3 Total Compensation

Scroll left or right

| Category | Number of Recipients | Amount (Annual) | |||

|---|---|---|---|---|---|

| Cash Compensation | Stock-based Compensation | Total | |||

| Monthly Compensation | Performance-based Bonus | ||||

| Directors | 12 | 271 million yen | 120 million yen | 55 million yen | 447 million yen |

| (Outside Directors) | (8) | (79 million yen) | (–) | (–) | (79 million yen) |

| Audit & Supervisory Board Members | 6 | 111 million yen | – | – | 111 million yen |

| (Outside Members) | (3) | (39 million yen) | (–) | (–) | (39 million yen) |

| Total | 18 | 383 million yen | 120 million yen | 55 million yen | 559 million yen |

*A resolution of the 158th Ordinary General Meeting of Shareholders held on June 21, 2024, held the amount of compensation for Directors to a maximum of 640 million yen annually (including compensation for Outside Directors to a maximum of 140 million yen annually).

*A resolution of the 158th Ordinary General Meeting of Shareholders held on June 21, 2024, held the amount of compensation for Audit & Supervisory Board Members to a maximum of 130 million yen annually.

Return of Stock Compensation

For the purpose of ensuring the soundness of the stock compensation system for Directors, the Board of Directors has established a provision to confiscate all or part of the stock-compensation before or after the lifting of the transfer restriction at the discretion of the Board of Directors in the event of a certain reason such as an unlawful act.

Training for Directors, Audit & Supervisory Board Members and Executive Officers

Directors and Audit & Supervisory Board Members attend external seminars and training sessions in order to accomplish such things as acquiring the knowledge necessary for the performance of their duties and work tasks, as well as to update their skills. The Company bears the costs of these activities.

It also provides annual compliance training for Directors, Audit & Supervisory Board Members, Executive Officers, and other employees such as senior employees (excluding Outside Directors).

In addition, we provide opportunities for Outside Directors to tour our manufacturing sites and receive an explanation of Daicel’s business activities so they can better understand our business and utilize their knowledge in discussions within Board of Directors meetings.

In FY2024/3, we conducted executive training on corporate ethics, explained the business of Polyplastics Co., Ltd., a major subsidiary of the Daicel Group, explained the business of the Material SBU, Safety SBU, and Smart SBU, and reported on our sustainability activities.

Establishment of the Internal Control System

Daicel develops and manages a system of internal controls under its Basic Policy for Structuring the Internal Control System to ensure the appropriateness of its business operations as stipulated under Japan’s Companies Act.

Furthermore, Daicel has established the Internal Control Council chaired by a senior managing executive officer, who concurrently serves as the general manager of the Corporate Support Headquarters and comprising general managers of corporate departments as members, to accurately grasp the status of the establishment and management of these systems and to discuss related measures toward ultimately ensuring the effectiveness of internal controls throughout the Group.

Standing Audit & Supervisory Board Members also attend meetings held by the council as observers. The council provides a report on its activities to the Audit & Supervisory Board and Board of Directors, and the Board of Directors has confirmed that the Basic Policy is being implemented appropriately.

Basic Policy for Structuring Internal Control Systems [PDF:107KB]

Policy Regarding Cross-Holding of Shares

Policy on Cross-Holding of Shares

Daicel only adheres to a shareholding policy insofar as it is judged to contribute to the improvement of the medium- and long-term corporate value of Daicel Group from the perspectives of, for example, strengthening business relationships, maintaining the stability of transactions with financial institutions, and maintaining or strengthening cooperative business relationships.

When any stocks do not meet the purpose of our possession or are not recognized as being economically rational due to changes in the business environment or other factors, we will reduce them accordingly.

We regularly review the purpose and appropriateness of all stocks we hold, as well as the quantitative and qualitative benefits of our business transactions and the economic practicality of the risk of such transactions. The results of these reviews are reported to the Board of Directors, which examines their content.

Cross Shareholdings of the Company (investment shares held for purposes other than to be net assets)

In line with the above-mentioned policy, in FY2024/3 the Company sold all shares of two securities and some shares of four securities out of 22 listed securities held by the Company. We also newly acquired shares of one unlisted security. As of the end of FY2024/3, the Company held 47 stocks for a balance sheet amount of ¥71.2 billion. Although the Company proceeded with the sale of strategic shareholdings as planned, the rise in share prices has increased the market value of shares. This resulted in an increase in the amount recorded on the balance sheet.

Scroll left or right

| FY2021/3 | FY2022/3 | FY2023/3 | FY2024/3 | ||

|---|---|---|---|---|---|

| Number of brands of stocks (brands) |

Unlisted stocks | 28 | 27 | 26 | 27 |

| Listed stocks | 26 | 25 | 22 | 20 | |

| Total | 54 | 52 | 48 | 47 | |

| Amount reported in the balance sheet (billions of yen) |

Unlisted stocks | 13 | 13 | 13 | 19 |

| Listed stocks | 645 | 653 | 576 | 692 | |

| Total | 659 | 666 | 589 | 712 | |

| Ratio of consolidated net assets (%) | 26.9 | 23.7 | 19.0 | 19.0 | |

Cross Shareholdings (top 10 securities) (as of March 31, 2024)

Scroll left or right

| Stock | No. of Shares | Amount Reported in Balance Sheet at Fiscal Year-end (Millions of yen) |

Purpose of Shareholding |

|---|---|---|---|

| FUJIFILM Holdings Corporation | 4,531,249 | 45,810 | Given our business transactions involving cellulose acetate and other products, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| Japan Tobacco Inc. | 1,500,000 | 6,081 | Given our business transactions involving acetate tow and other products, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| Tokyo Ohka Kogyo Co., Ltd. | 813,300 | 3,724 | Given our business transactions involving organic chemicals, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| DAIKIN INDUSTRIES, LTD. | 156,000 | 3,213 | We have continuously held the shares to maintain and strengthen our favorable relationship with the company in pursuing joint development of products and other activities. |

| NAGASE & CO., LTD. | 1,197,000 | 3,057 | Given our business transactions involving organic chemicals, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| Mitsubishi UFJ Financial Group, Inc. | 981,790 | 1,528 | We have continuously held these shares to maintain and strengthen our favorable relationship with the company to ensure stable financial and settlement operations for the Daicel Group. |

| Sumitomo Mitsui Financial Group, Inc. | 145,520 | 1,296 | We have continuously held these shares to maintain and strengthen our favorable relationship with the company to ensure stable financial and settlement operations for the Daicel Group. |

| Toyoda Gosei Co., Ltd. | 369,700 | 1,199 | Given our business transactions involving automobile airbag inflators and other products, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| Osaka Soda Co., Ltd. | 64,800 | 625 | Given our business transactions involving organic chemicals and other products, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

| Nihon Plast Co., Ltd. | 1,000,000 | 559 | Given our business transactions involving inflators for automobile airbags and other products, we have continuously held these shares to maintain and strengthen our favorable relationship with the company. |

Cross Shareholdings of the Company (total investment securities and deemed holdings of shares for purposes other than to be net assets)

Scroll left or right

| FY2021/3 | FY2022/3 | FY2023/3 | FY2024/3 | |

|---|---|---|---|---|

| Total amount of cross-shareholdings (billions of yen) | 856 | 891 | 730 | 925 |

| Ratio of consolidated net assets (%) | 34.9 | 31.9 | 23.5 | 24.7 |

Plan for Future Stockholding Reductions

In light of various circumstances that include the impact on the market and the financial strategies of the issuing entity, the Company plans to sell any stock that fails to satisfy our purpose for shareholding or that is deemed to be no longer economically practical due to factors that include changes in the business environment.

The balance of cross shareholdings not including deemed holdings of shares and cross shareholdings including deemed holdings of shares as a proportion of consolidated net assets from FY2025/3 to FY2026/3 is expected to be as shown below.

Although the reduction plan has not been revised, the ratio of strategic shareholdings to consolidated net assets is expected to increase due to the rise in stock prices compared to May 11 2023’s external announcement.

Scroll left or right

| FY2025/3 | FY2026/3 | |

|---|---|---|

| Total amount of cross-shareholdings (excluding deemed holdings of shares) (billions of yen) |

549 | 370 |

| Ratio of consolidated net assets (%) | 13.7 | 9.5 |

| Total amount of cross-shareholdings (including deemed holdings of shares) (billions of yen) |

761 | 582 |

| Ratio of consolidated net assets (%) | 19.1 | 14.9 |

*The Company’s reduction plan is based on information obtained by the Company as of May 26, 2023 and on certain assumptions deemed to be reasonable. Actual figures may diverge from the plan due to various factors.

Communication with Shareholders and Investors

Appropriate Information Disclosure and Constructive Dialogue

Daicel encourages fair evaluation of its corporate value by following its Disclosure Policy to foster accurate understanding of the Company among its stakeholders, including shareholders and investors. With the aim of building relationships of trust with all its stakeholders, Daicel has disclosed corporate information in a timely, impartial, accurate, and proactive manner on an ongoing basis. We also carry out IR activities to engage in dialogue with our shareholders and investors to further enhance our corporate value.

Our Disclosure Policy, including our basic policy on information disclosure

General Meeting of Shareholder

We have considered the Annual General Meeting of Shareholders as a valuable opportunity to engage with our shareholders. For this reason, Daicel posts the convocation notice for its Annual General Meeting of Shareholders on its website prior to distributing it by postal mail, aiming to provide shareholders with sufficient time to examine the agenda items. Moreover, to ensure that as many shareholders as possible to exercise their voting rights, we offer voting alternatives via postal mail or the Internet, using computers, smartphones and other devices, for those who are unable to attend the meeting.

To facilitate their further understanding of initiatives of the Daicel Group, we are striving to provide easy-to-understand answers to questions voiced by shareholders.

At the Ordinary General Meeting of Shareholders held on June 23 2023, when COVID-19 had already been classified as a Class 5 disease, infection prevention measures were continued at the venue, while the time required for the General Meeting of Shareholders was limited to one hour or less, and the limit on the number of questions from shareholders was eliminated. With the safety of our shareholders as a top priority, we held the General Meeting of Shareholders with an emphasis on dialogue, using it as a valuable opportunity for communication with our shareholders.

IR Activities

Under the supervision of the officer in charge of IR, the Company promotes IR activities in cooperation with the management team including the President and CEO, and related departments such as the IR department. In line with the forementioned basic policy on Information disclosure, Daicel adopts a proactive approach toward its IR activities.

By holding quarterly financial briefing session and things such as individual interviews, interviews at conferences sponsored by securities companies, and small meetings with the President and CEO, the Company strives to promote communication, aspiring to foster better understanding of the Daicel Group among institutional investors. In FY2024/3, we held business briefings on the Life Sciences and Engineering Plastics businesses as well as small meetings with Outside Directors as opportunities to promote a better understanding of the Daicel Group's businesses.

We provide information to individual investors through our corporate website, and strive to enhance its content so that they can understand the Daicel Group in an easier-to-understand manner. Furthermore, we conducted an online survey of 2,000 individual investors to develop a deeper understanding of the Daicel Group and ask their opinion about Daicel Group.

Furthermore, we offer an email newsletter service providing information that Daicel has published on TDnet and EDINET. Please follow this link to sign up for our investor relations email newsletter.

FY2024/3 Activities

Scroll left or right

| Activity | Frequency | Outline |

|---|---|---|

| Financial briefing sessions for analysts and institutional investors | 4 | Held briefings on a quarterly basis (the second and fourth quarter briefings were hosted by the President and CEO, while the first and third quarter briefings were hosted by the Head of the Investor Relations Department) |

| Strategy briefings for analysts and institutional investors | 2 |

Held briefings as follows: Engineering Plastics business on June 16, 2023 Life Sciences business on December 7, 2023 |

| Individual interviews with analysts and institutional investors | Approx. 160 interviews | Hosted by the Investor Relations Department centered on the head of the Investor Relations Department or the officer in charge of IR |

| Small meetings with domestic institutional investors | 3 | Held opinion exchange meetings with domestic institutional investors by the President and CEO and Outside Directors |

| Participation in conferences for overseas investors | 3 | The officer in charge of IR and the head of the Investor Relations Department participated in conferences in Japan for overseas institutional investors held by securities companies |

Feedback on Dialogue with Shareholders and Investors

The IR department feeds back to management and related departments as needed about the content of dialogues with shareholders and investors, their opinions and requests, and the content of analyst reports. In addition, the officer in charge of IR reports the dialogue to the Board of Directors and the IR department reports it to the management team on a quarterly basis at the meetings, which is used in discussions aimed at improving our corporate value.