Sustainability / Environmental ReportInformation Disclosure in Line with TCFD Recommendations

Basic Approach

The Daicel Group endorsed the TCFD* recommendations in November 2021. In accordance with the recommendations, the Group will continue to disclose information on each item related to climate change for governance, strategy, risk management, and metrics and targets.

*Task Force on Climate-related Financial Disclosures

Governance

Our response to climate change is discussed at the management level. At the Sustainable Management Committee held three times in FY2025/3, discussions mainly focused on responses to climate change, including the implementation of the “Certification System for the Contribution to Build a Circular Society" (System name: CycloVia), initiatives to reduce GHG emissions, and the implementation of an internal carbon pricing system, with the details reported at the Board of Directors.

Strategy

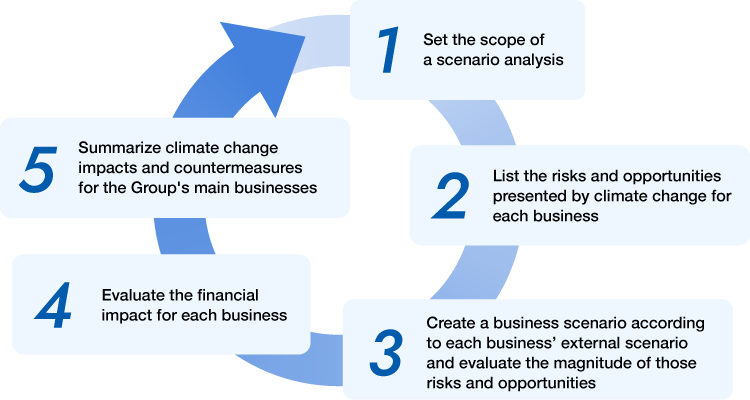

In order to examine strategies and organizational resilience in light of climate-related risks and opportunities, the Daicel Group conducted a scenario analysis using the following procedures with reference to climate change scenarios from the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) and considered the impact as of 2030.

● Implementation procedures for scenario analyses

Scenario analyses follow the procedures listed below.

● Scenario analysis conditions and overview

- ①Scenario analysis scope

The following businesses were evaluated as the Group's main business areas.

- Engineering Plastics Business (Polyplastics)

- Acetyl Business centered on cellulose acetate (Material SBUs)

- Safety Business (Safety SBU)

- ②Time frame

We examined transition risks, physical risks, and transition opportunities in 2030.

- ③Assumed scenarios

Based on information from the IPCC, IEA, and other sources, we examined the risks and opportunities of two scenarios: one in which decarbonization progresses (1.5°C/2°C scenario) and the other in which decarbonization does not progress (4°C scenario).

As the temperature increase in 2030 in both the 4°C scenario and the 1.5°C/2°C scenario is around 1.5°C and not significantly different from one another, the physical risk in 2030 is assumed to be similar in both the 1.5°C scenario (in part, below 2°C scenario) and the 4°C scenario. Therefore, no distinction is made for each of the two scenarios in terms of physical risk, and the same situation is predicted for 2030.

Scenario overview

Scroll left or right

| 1.5℃/2℃ | 4℃ | |

|---|---|---|

| Societal changes |

|

|

| Technological innovation |

|

|

| Climate change |

|

|

*Carbon dioxide Capture and Utilization

● Scenario Analysis Results -Risks and Opportunities-

The following table shows the risks and opportunities related to climate change in the analyzed businesses, their degree of impact, and proposed countermeasures.

Scroll left or right

| Risks/ Opportunities |

Category | Details | Overall | Engineering Plastics (Polyplastics) |

Acetyl Chain | Safety | Response | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4℃ | 1.5/2℃ | 4℃ | 1.5/2℃ | 4℃ | 1.5/2℃ | 4℃ | 1.5/2℃ | ||||

| Transition Risks | Policies and Regulations | Increased operating costs due to the introduction and strengthening of carbon pricing (taxes) | ● ● | ● ● ● | ● ● | ● ● ● | ● | ● ● ● | ● | ● ● ● | Promote activities to achieve the GHG emissions reduction target (50% reduction in total compared to FY2019/3) Quantify risks associated with ICP implementation |

| By introducing and strengthening carbon pricing (taxes), the increased costs to upstream business partners are passed on, resulting in higher procurement costs | ● ● | ● ● ● | ● ● | ● ● ● | ● | ● ● ● | ● | ● ● ● | Reduce the impact by promoting the reduction of GHG emission intensity in cooperation with suppliers Switch to low-GHG raw materials |

||

| Strengthening of GHG emissions regulations based on carbon emission targets and policies of each country, including EU Carbon Border Adjustment Measure | ● ● | ● | ● ● | ● | - | ● | Promote activities to achieve the GHG emissions reduction target (50% reduction in total compared to FY2019/3) Switch to energy-saving, low-GHG raw materials, and change suppliers |

||||

| Market | Price fluctuations of petrochemical-derived raw materials to realize a low-carbon society | ● ● ● | ● ● | ● | ● ● ● | ● | Optimize inventory management Promotion of multiple purchases, simplification of raw materials through formulations, and standardization of quality through improvement of manufacturing technology |

||||

| Technology | Increase in equipment investment costs for energy saving and productivity improvement | ● ● | ● ● | ● ● | - | Resolve risks by accelerating the development of technology and know-how for formulation design and technical services | |||||

| Reputation | Identification of and response to risks and opportunities related to climate change, and increasing demand for disclosure of environmental management information | ● | ● | - | - | Reinforce systems and structures related to environmental measures Continue disclosing information related to the environment in accordance with the changing needs of society |

|||||

| Physical Risks | Chronic/ Acute |

Intensification of disasters due to abnormal weather conditions (heavy rain, floods, and typhoons), resulting in suspension of operations and damage to raw materials and products Supply chain disruptions |

● | ● | ● | ● | Strengthen BCP for climate change | ||||

| Chronic | Worsening working conditions and the spread of infectious diseases due to the rise in average temperature | - | - | - | - | Continue making work environment improvements | |||||

| Transition Opportunities | Market | Expansion of new markets for environment-friendly products (Biodegradable plastics, EVs, renewable energy, recycling, and water resource conservation) |

● ● ● | ● ● | ● ● ● | ● ● | Develop recycling business (re-compounding business) Develop low-GHG products (utilization of CCU technology, and development of bio-based products) Functionalize cellulose acetate, develop new fine cellulose, and commercialize BIC*1 projects Develop market for EV current interrupters Operate CycloVia*2 |

||||

| Resource Efficiency |

Reduction of operating costs through energy saving and productivity improvements | ● ● ● | ● ● ● | ● ● ● | ● | Adopt DAICEL Production Innovation and the Autonomous Production System | |||||

| Other Reduction Activities*3 | ● ● | ● ● ● | ● ● | ● ● ● | ● | ● ● ● | ● | ● ● | |||

(Impact) ● ● ●:Over 10 billion yen, ● ●:Several billion yen, ●:Less than 1 billion yen, -: Almost no impact

- *1Biomass Innovation Center: The research division of our company aiming to convert biomass resources into raw materials.

- *2CycloVia: Name of our in-house certification system, the “Certification System for the Contribution to Build a Circular Society.”

- *3Other reduction activities: Investment for a 50% reduction in GHG emissions (Scope 1, 2), reducing the impact of carbon pricing due to GHG emission reductions, transitioning to low-GHG raw materials, overall reduction activities in the supply chain, etc.

Risk Management

The Daicel Group regards climate change as a major risk in sustainable management, and we conduct risk assessments, formulate responses, and confirm implementation status as part of the Group's risk management system. The Sustainable Management Committee conducts detailed examinations for key issues.

Metrics and Targets

The Group has listed “Respond to climate change,” “Provide environment-friendly materials and technology,” and “Contribute to the development of a circular society” as three of its 15 key sustainability issues (materiality), and has set KPIs for each. For “Respond to climate change” we will further develop energy-saving measures to achieve GHG emission reduction targets and carbon neutrality by 2050. In addition, in January 2025, we launched an in-house certification system, the “Certification System for the Contribution to Build a Circular Society” (System name: CycloVia). In April 2025, we also implemented an internal carbon pricing system. We will build a new structure by utilizing these systems as indicators of risks and opportunities.

| Materiality | Metric | Target | Results (FY2025/3) |

Note |

|---|---|---|---|---|

| Respond to climate change | GHG emission reduction rate of our Group*1 | Scope 1 and 2 FY2031/3: 50% reduction (compared to FY2019/3) |

0.5% reduction |

|

| Provide environment-friendly materials and technology | Rate of recyclable raw materials*2 used in products | FY2031/3: 30% or more | 16.5% |

|

| Contribute to the development of a circular society | Number of external proposals for resource recycling systems using natural materials | FY2026/3: 3 cases | 1 case |

The Group's Sustainable Management Policy includes the development of circular processes that coexist with the global environment. We will continue to discuss products and services that contribute to a low carbon economy and consider setting better metrics and targets.