About DAICELLong-Term Vision and Mid-Term Management Strategy

In fiscal 2020, the Daicel Group formulated "DAICEL VISION 4.0," our long-term vision targeting fiscal 2030. As a means of implementing this vision, our Group also formulated "Accelerate 2025," a Mid-Term Management Strategy culminating in fiscal 2025. With this innovative vision and strategy as our new guidelines, we are focused on responding with flexibility to a variety of issues related to the international community and the global environment. These issues include shifting social circumstances as well as the rapid technological progress arising from the widespread adoption of artificial intelligence (AI) and the internet of things (IoT). Through these business initiatives, we will contribute to the emergence of a society committed to sustainability while pursuing the ongoing growth of the Daicel Group.

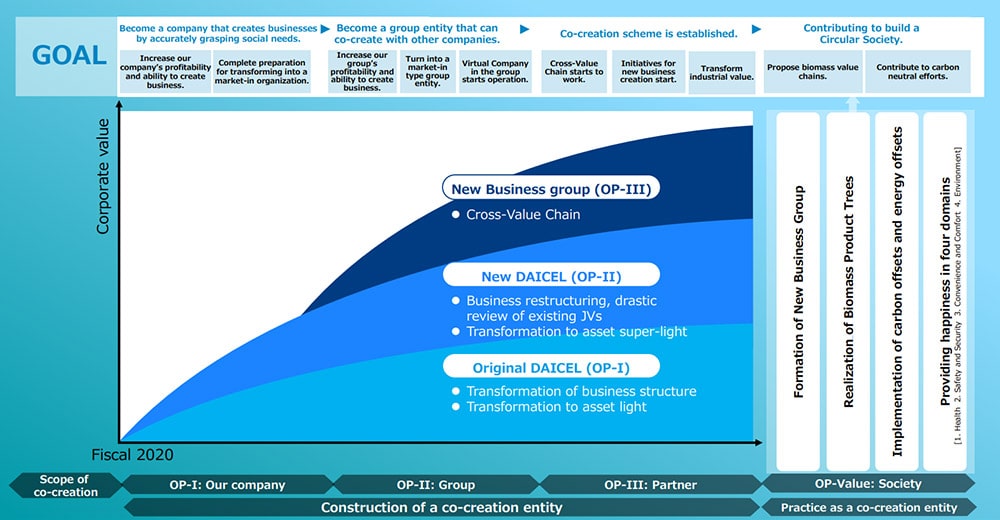

The Path to Implementing Our Long-Term Vision

As we remain focused on the well-being of our employees and the sustainability of our products and manufacturing processes, we aim to provide the value demanded by society as we contribute to human happiness and the emergence of a society committed to recycling. To this end, we intend to expand the scope of our value co-creation to encompass Daicel itself, our Group companies, and our business partners and customers who are linked through the supply chain. In this way we will provide society with greater value than a single company alone could offer.

At the original Daicel (OP-Ⅰ), in addition to maintaining our current business, we will transform our corporate structure and promote an "asset-light" approach emphasizing comprehensive cost reductions, particularly in the domains we focus on.

Under the new Daicel (OP-Ⅱ), we will work to expand our business domains through mergers, acquisitions, and alliances in areas related to our existing businesses; reorganize existing businesses; and fundamentally review joint ventures with the aim of transforming the entire Group into an exceptionally asset-light entity.

Our new corporate group (OP-Ⅲ) seeks to provide value that extends beyond the scope of the Group by first strengthening our vertically integrated value chain (supply chain), working on value creation (co-creation) for our respective customers, and expanding co-creation horizontally with other companies in the same industry as well as universities.

In addition, in order to achieve the goal of our long-term vision of "Contribution to Building a Circular Society", we intend to implement the "four transitions" that will significantly change how we forge society.

Formation of a New Business Group (Value Co-Creation Entity)

We will expand the value co-creation scope from Daicel Corporation (non-consolidated) to the Daicel Group (consolidated) and then include our partner companies as well. Beyond the boundaries of departments and companies, industries, academia, and governments, we will share the same aspirations and strive to create value together.

Realization of Biomass Product Trees

We are developing the technology for melting wood at room temperature and under normal pressure conditions. By utilizing dormant forest resources in Japan as a renewable resource, we will create new product trees where both products and manufacturing processes are environmentally-friendly.

Implementation of Carbon Offsets and Energy Offsets

We will conserve energy through production process innovation. Also, we continue to develop technologies that enable reuse and efficient utilization of emitted carbon while maximizing our competitive advantage in manufacturing as we improve productivity, reduce costs, and minimize environmental load.

Provision of Happiness in Four Domains

Our competitive advantage in these domains (Health, Safety/Security, Convenience/Comfort, Environment) allows us to respond to the social trends and increasing needs. By leveraging our unique materials and technologies we have cultivated since the founding, we will continue to create and deliver new value.

Mid-Term Management Strategy

To achieve this, we aim to provide value by strengthening and growing our existing businesses while contributing to the emergence of a society committed to recycling. We will achieve this by promoting initiatives in support of the following basic strategies.

Main Initiatives Outlined in the Mid-Term Management Strategy

In our Mid-Term Management Strategy, we categorize concrete initiatives for each OP described in the Long-Term Vision by the "Company-wide strategy," "Business strategy," and "Functional strategy." We will increase our profitability and ability to create business while implementing these measures in each operation and expanding the value co-creation scope.

Portfolio Management

The Daicel Group integrates a diverse array of businesses into 32 businesses and manages its portfolio in the "next generation," "growth," "foundation," and "reform" categories.

Our businesses are categorized by industrial growth, competitive environment, sales growth, operating profit, and business characteristics. We perform a tilted allocation of management resources in line with the portfolio and regularly evaluate the results in terms of ROIC and sales growth rate.

While steadily improving the profitability of our core businesses and developing growth-focused businesses, we will accelerate the development of new businesses in our four main business domains: Health; Safety and Security; Convenience and Comfort ; and Environment , which is centered on our long-term vision of contributing to the emergence of a society committed to recycling.

Company-wide Performance and Management Indicators

We are committed to paying a stable dividend that reflects our consolidated business performance. We will achieve this by pursuing maximum asset efficiency and an optimal capital structure while ensuring a sound financial footing that enables us to maintain our ability to raise funds.

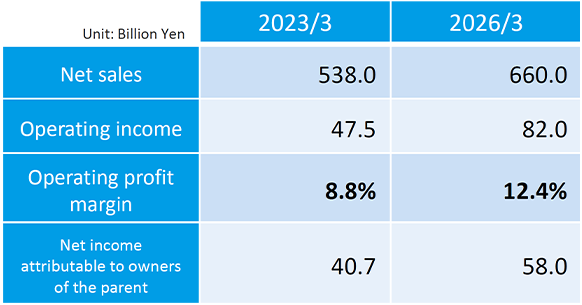

In fiscal 2025, the final year of our current Mid-Term Management Strategy, we are targeting the following company-wide performance and management indicators.

- Company-wide Performance:

- Net sales of 660 billion yen; operating income of 82 billion yen; net income attributable to owners of parent of 58 billion yen; and EBITDA of 136.0 billion yen.

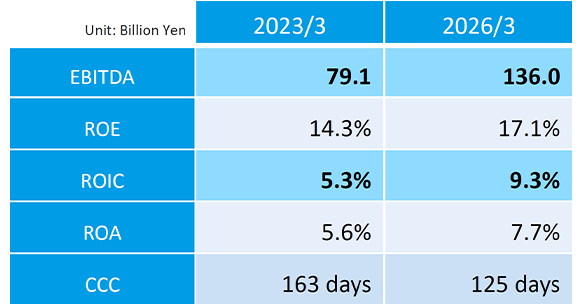

- Management Indicators:

- Operating profit margin of 12.4%; ROE of 17.1%; ROIC of 9.3%; ROA of 7.7%, and CCC of 125 days.

- Shareholder returns : A minimum cash dividend per share of 32 yen was adopted at the time of the announcement of our Mid-Term Management Strategy, representing a minimum total return ratio of 40%.

* From fiscal year ending March 2025, we have introduced DOE (dividend on equity) as a new indicator in addition to a total return ratio. We aim for DOE of 4% or more and a total return ratio of 40% or more.

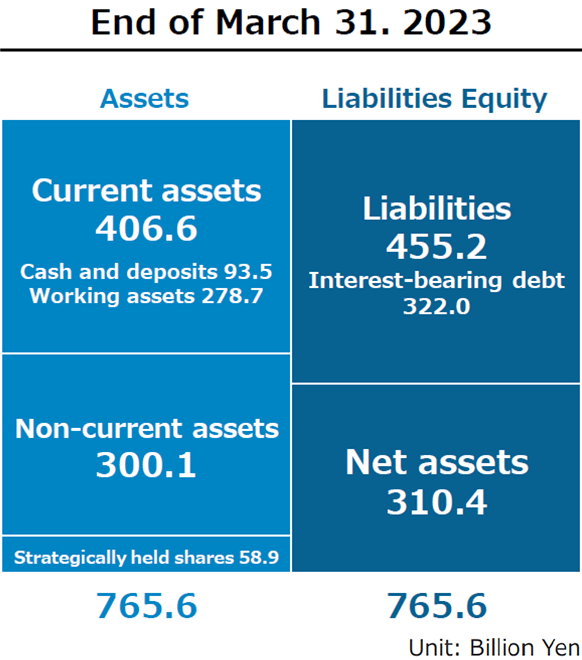

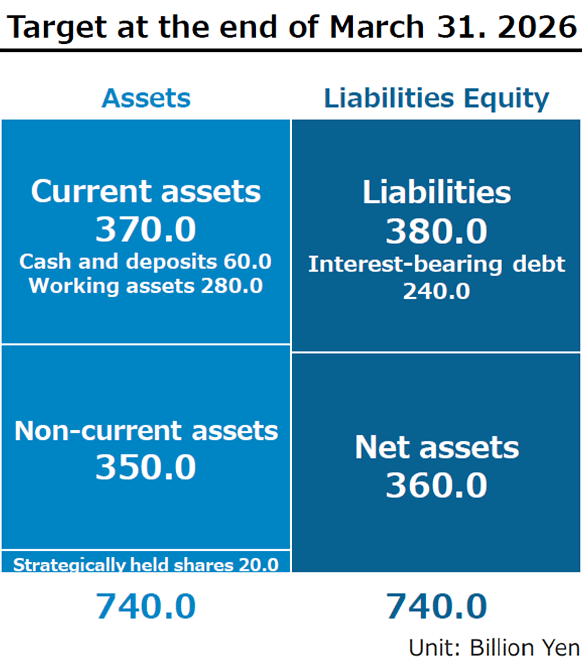

In addition, in keeping with our policy of remaining an asset-light company, we envision the following balance sheet as of March 31, 2026: achieving an equity ratio exceeding 45% and a maximum net D/E ratio of 0.5 to strengthen our financial stability while maintaining a total asset balance even during our expansion period.

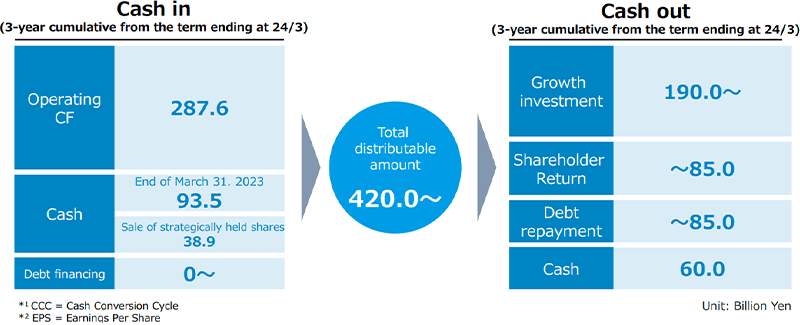

Ability to Generate Funds

In addition to strengthening profitability, we will improve our ability to generate funds by reducing the cash conversion cycle through measures such as proper inventory management. Moreover, we will further increase our ability to generate funds through the sale of cross-investments and the like and by utilizing surplus funds for growth investments and shareholder returns. We will aim for a minimum total return ratio of 40% for shareholder returns and will respond flexibly with regards to the purchase of treasury shares.

References

Mid-Term Management Strategy Accelerate 2025-Ⅱ(Updated) (May 11, 2023) [PDF:4.2MB] Mid-Term Management Strategy Accelerate 2025-Ⅱ(Feb 17, 2021) [PDF:9.2MB] Mid-Term Management Strategy Accelerate 2025(June 8, 2020) [PDF:1.5MB] The Fourth Long-Term Vision DAICEL VISION 4.0( June 8, 2020) [PDF:2.8MB]